The Bitter Pill Of Messing Up A Monster Trade

Mar 11, 2025

If you’re struggling in this market, you’re not alone.

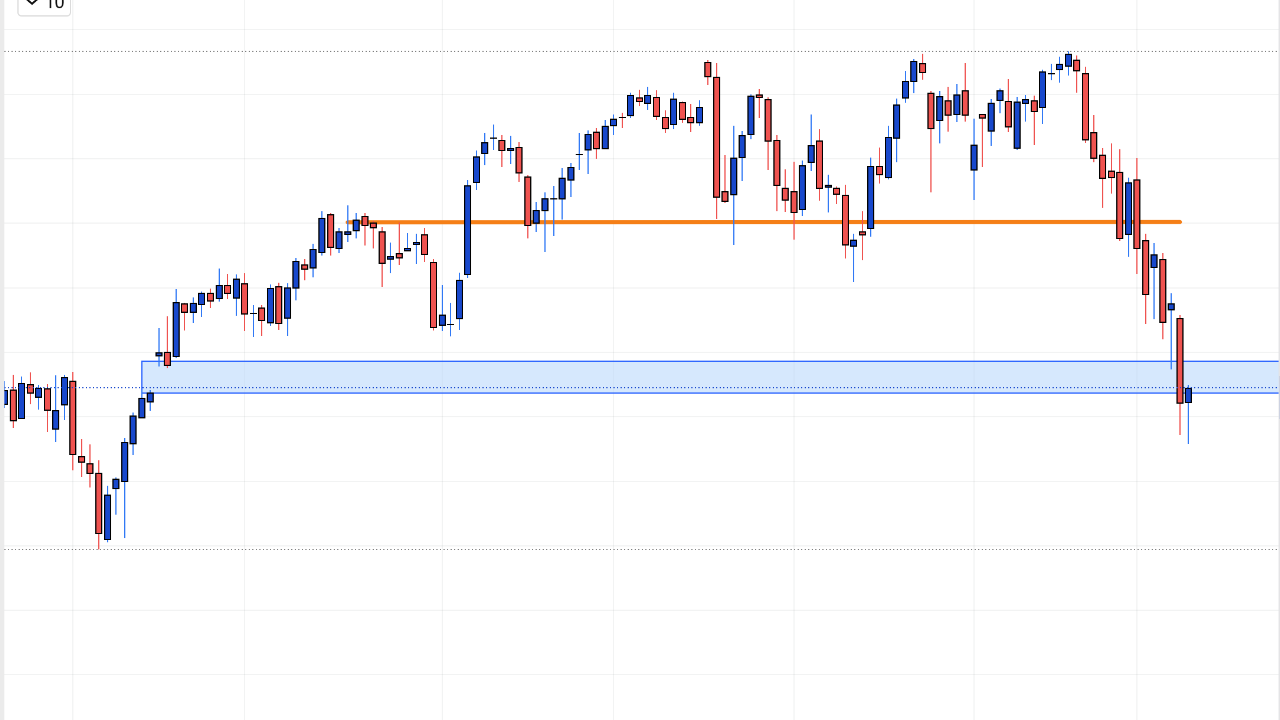

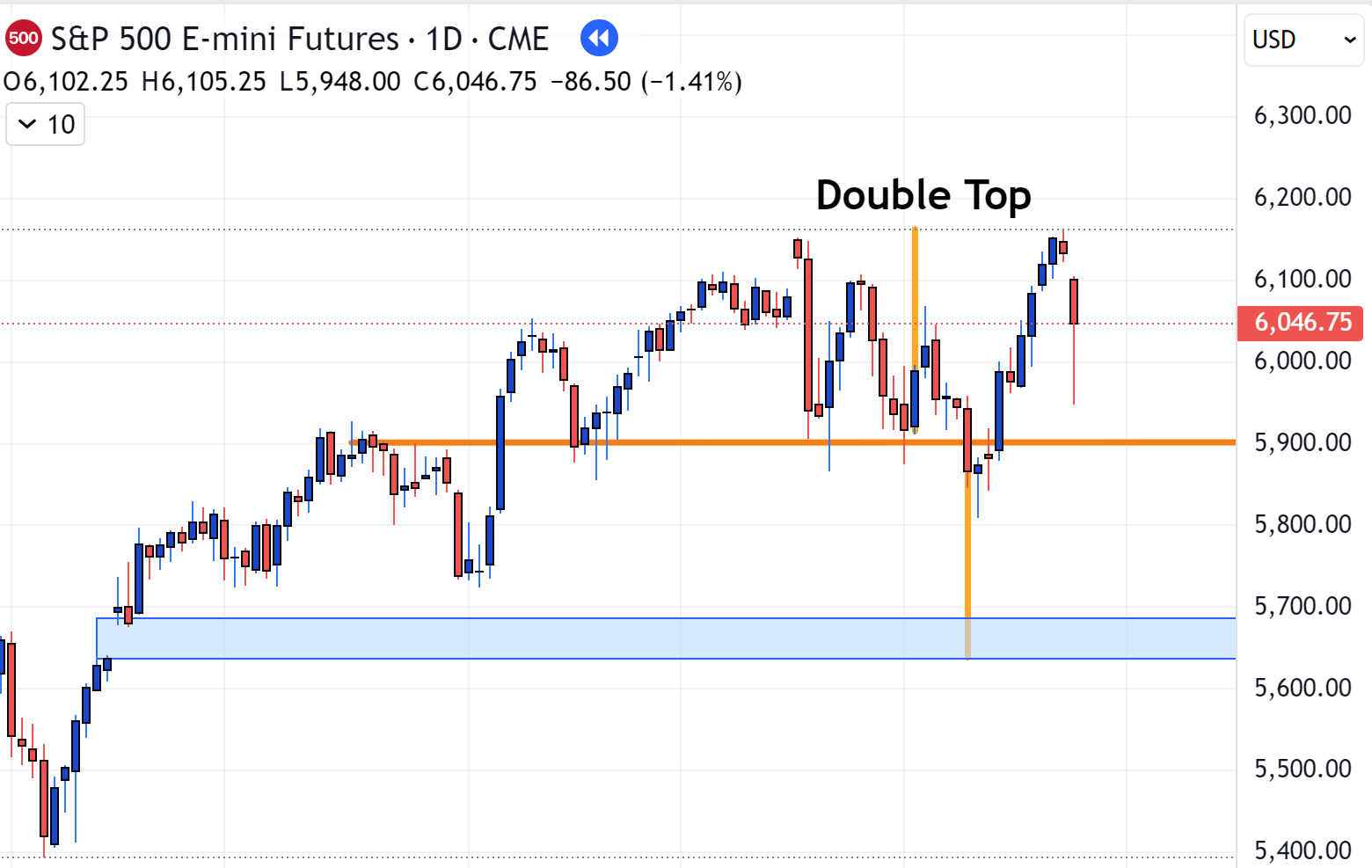

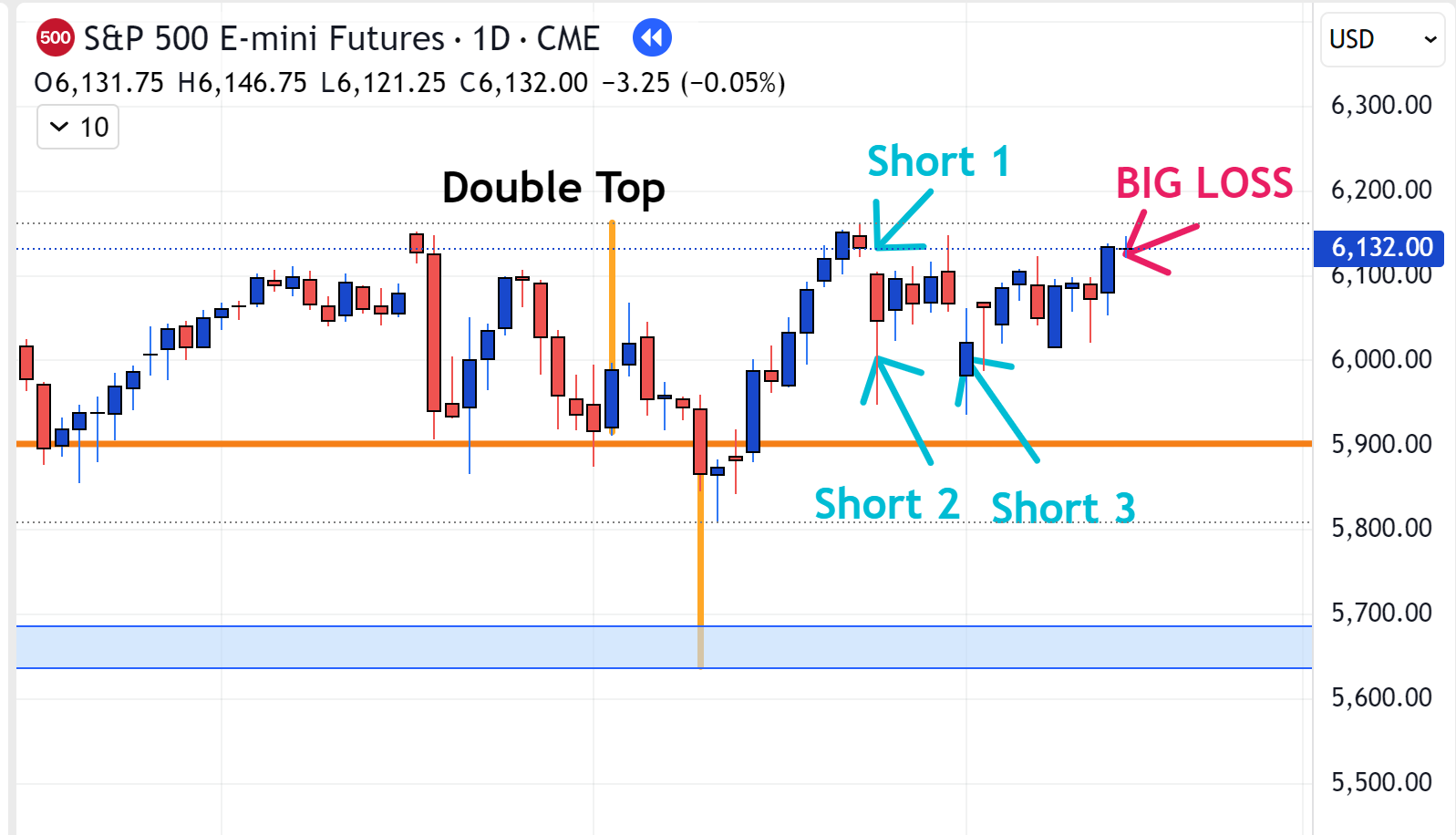

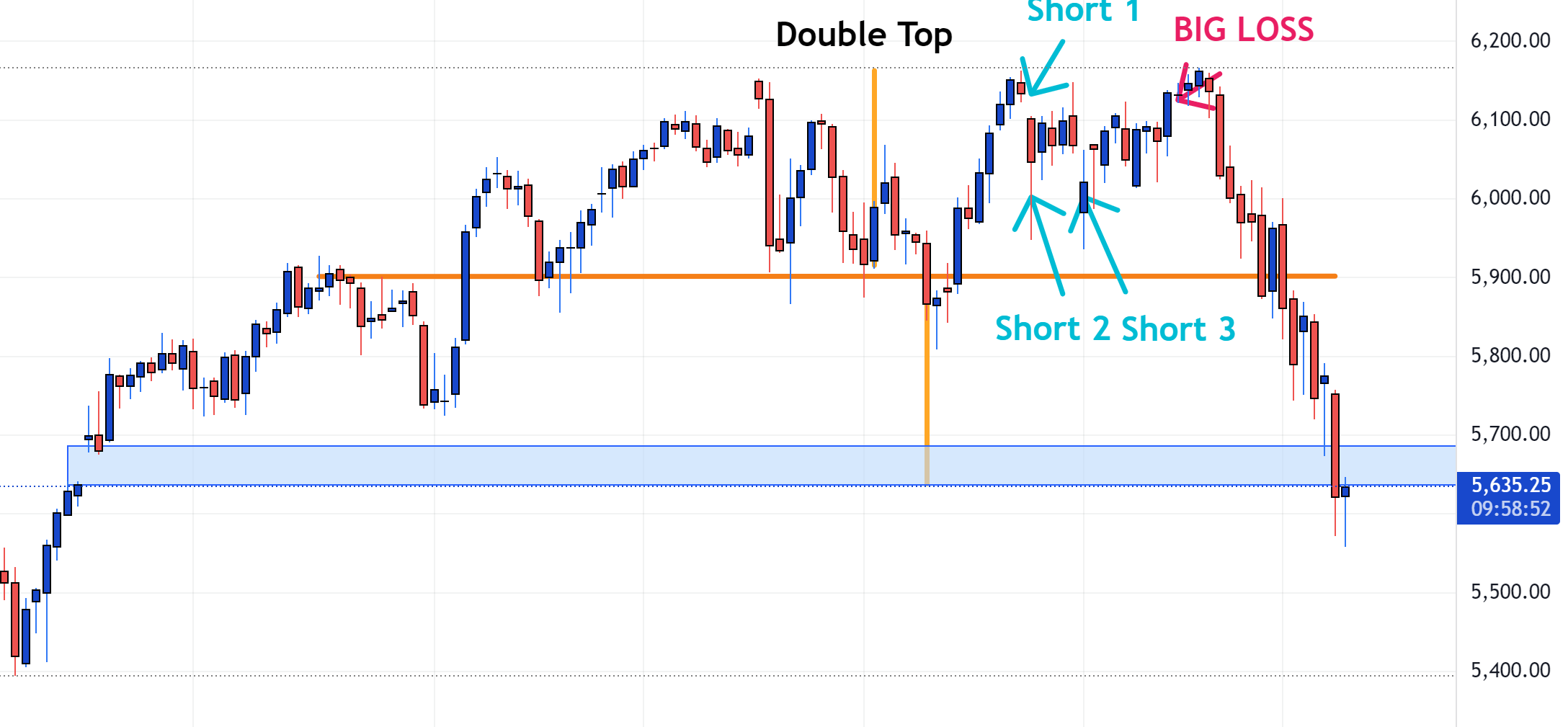

This morning, I worked with a trader who traded a double top setup in the ES. He nailed the top on the 24th of January, shorted it, and watched with a great sense of anticipation of the profits to come as the market dropped and his position quickly becoming profitable.

The double top projection price target fitted perfectly into the previous gap, so he had a high conviction in this trade.

When the 6000 mark was breached, he thought why not go big and make a real profit! So he added two more contracts to his short position.

But as Trader Murphy’s Law would have it, he did so at the exact wrong moment. The ES bounced back, and before he knew it, his hard-earned profits started evaporating fast.

But he was so convinced that the market is due for a retracement that he added another 2 contracts to his short position when the ES crossed the 6000 mark a 2nd time; so now all up he was short 6 contracts which accelerated the loss drastically when the ES decided to retest the high for a 3rd time.

Convinced it was just a minor retracement, he held on, expecting the market to resume its downward move. His strong bearish bias blinded him to the bigger picture—he was fixated on profits rather than market structure.

Then came the ultimate sting. He was forced to exit at the top after nearly wiping out his account, only to watch the market turn back down right to his original target—without him because he had lost his trust in the trade and missed the entry of the triple top.

Devastated, he reached out to me for help processing the emotional toll and regaining his trading mindset.

Key Takeaways:

1️⃣ Have an exit strategy. He hadn’t considered that adding to his position could amplify losses faster than he had gained them. In volatile markets, protecting profits is just as important as making them.

2️⃣ Define your risk limits. We set a rule: If he gives back more than 50% of his profits, he banks the rest, reassesses, and either re-enters or looks for a fresh setup.

3️⃣ Differentiate retracements from reversals. We practiced identifying the difference and modeled how to adjust trades accordingly.

Don't underestimate the psychological impact it has on your trading mindset when you analysed a Monster Trade correctly, but executed it badly.

The thing is, if the trader hadn't had such a big position but stayed with the original 2 contracts, he could have ridden out the third drive to the top and still made a monster profit.

But because he was so overleveraged in the end, he had to fold just 2 days before the market finally turned and hit his target.

It's a bitter pill to swallow, and the emotional impact must not be underestimated. That's why it is super important that if you have the experience of mismanaging your trade, getting served a big loss instead of the profit you were dreaming about, acknowledge how much it sucks. Feel sorry for yourself for a little while.

And now, it’s time to get back on the horse, let go of the past, and stay focused on the next high-probability setup and create a new future. 🚀